NAVIGATING MARKETS WITH CONFIDENCE

GBMC

December 16, 2024

Financial Times

LNG TANKER FREIGHT HAS FALLEN DRAMATICALLY: THERE ARE MORE SHIPS THAN GOODS

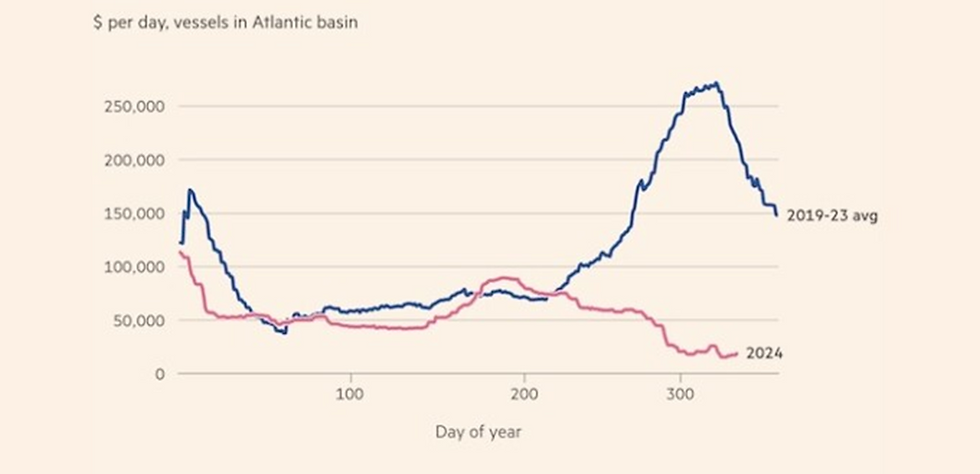

Cost of freight. Source: Financial Times

In November, short-term charters for a modern LNG tanker – the dominant ship type in the market – in the Atlantic basin averaged $19,700 a day, according to Spark Commodities. That’s the lowest price since 2019. Freight prices have fallen almost 80% since the summer as new ship deliveries outpace global LNG production growth.

Brokers, analysts and LNG traders said base rates for older, less efficient ships have also fallen sharply. For steam-turbine powered LNG tankers, the least efficient on the market, “earnings after items such as operating costs are in many cases negative or close to zero,” according to one broker.

Such low rates mean some shipowners will not cover the costs of chartering ships, which is likely to lead to a period of adjustment in the industry, such as scrapping older vessels.

Negative LNG tanker rates are rare, but were recorded in February 2022, on the eve of the start of the military conflict between Russia and Ukraine. As a result, fuel costs, which Spark says shipowners pay for ballast, when the ship is not carrying cargo, have risen sharply, leading to negative rates.

The decline in freight rates this year was driven by more ships coming to market at a time when the cargo they were carrying wasn’t arriving as quickly as expected due to project delays.

Shipowners placed a significant number of orders during the European energy crisis caused by the Russian-Ukrainian conflict. They were counting on increased demand for seaborne fuel shipments as Europe seeks to replace lost Russian gas with LNG imports.

There were about 650 LNG tankers in operation last year, according to the International Gas Union. The LNG shipping company will add 68 ships by the end of this year and 88 in 2025, according to Flex LNG. More than 80 ships will be delivered each year through 2027, according to Flex.

However, the additional LNG export volumes for which these vessels were ordered have not materialized as expected, largely due to delays in the development of LNG export terminals in the United States, now the world’s largest exporter of liquefied fuels and a major source of gas for Europe.

LNG export volumes typically grow by 6-8% annually, but this year growth will be just 1%, Øystein Kalleklev, CEO of Flex LNG, said on an earnings call in November. “This also explains why the spot freight market is so weak,” he said.

Europe has also imported less LNG than in previous years due to high levels of gas storage: last winter was milder than usual, which reduced demand for liquefied gas.

In addition, traders have not used floating storage — storing ships loaded with LNG in the water until prices rise before winter — as much this year as in previous years, due to the lack of significant price differences between summer and winter. That has freed up more tankers.

Some older ships will be released from long-term contracts this year, brokers say, adding to the glut of ships.

Actual shipping deals with zero or negative rates have not yet occurred and remain only theoretically possible, brokers and analysts say. However, owners of older ships can charter them at these rates if this is justified after assessing the costs of dismantling or disposal. Such tankers can be used to store LNG at the required low temperature.

“There could be real charter deals where owners charter a vessel at or near zero base rates for a short period of time,” said Claire Pennington, an LNG shipping expert at consultancy ICIS. “There could be a situation where some owners are stuck with a steamboat and are torn between the cost of taking it off the market or chartering it to keep it warm.”

“A lot will depend on how long owners have to wait to scrap the vessel and how much cheaper it will be for them,” she said.

Although energy companies expect demand for LNG to rise sharply over the coming decades, largely due to developing Asian countries switching from coal to gas, the cost of chartering LNG vessels is likely to be under pressure in the short term.

Martin Senior, deputy head of LNG pricing at Argus Media, the pricing agency, said that while 251 new tankers are expected to be delivered between 2025 and 2027, new export capacity coming online in the same period could require only 171 additional vessels.

“The market is pricing in a well-stocked LNG tanker market for next year, with 2025 term charter rates well below levels seen in previous years,” Senior said.